5 min read

How to Improve Your Credit Score (Without Losing Your Mind)

Practical, stress-free strategies to boost your credit score and unlock more financial opportunities.

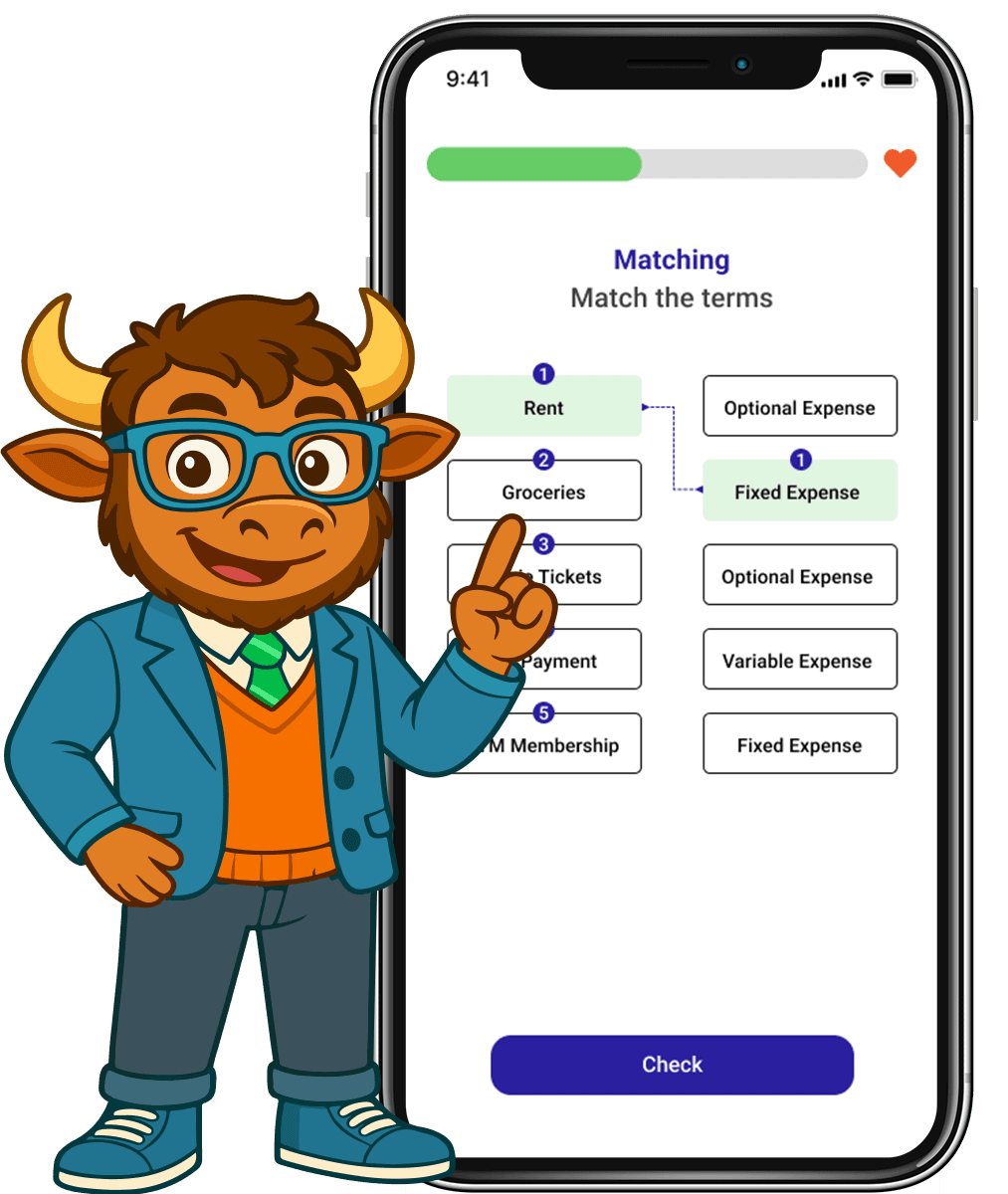

SIMMER gives you the real-world money skills you were never taught. Learn the basics, understand your finances, and put it into action with tools that help you build a budget, pay off debt, and plan for your future.

Real skills, real life, and tools that help you feel in control fast.

I learned a new term from SIMMER: ‘girl math.’ I didn’t even know that was a thing! Now let’s change the definition with financial literacy powered by SIMMER, so girl math means ‘empowered girls who own their financial independence’! Kudos to the SIMMER team for making finance feel relatable.

Entrepreneur @ Enterprises, LLC

The concept of SIMMER is exactly what we need. Financial education tailored to our interests, coupled with practical financial tools, is a game-changer. I can’t wait to see this idea come to life.

Entrepreneur @ KAIMA Enterprises, LLC

I feel more confident meeting with my financial planner since I started learning with SIMMER. You always hear these financial terms, but never really understand them. Now, I actually get what they mean.

Healthcare Director @ Children’s Hospital of the King’s Daughters

Fresh takes, real stories, and easy breakdowns that make money feel way less confusing. Every week, we cover real-life choices and simple habits in a way that actually clicks. Scroll through the latest.

5 min read

How to Improve Your Credit Score (Without Losing Your Mind)

Practical, stress-free strategies to boost your credit score and unlock more financial opportunities.

4 min read

Back-to-School, Back-to-Basics: Teaching Kids About Money

Simple, everyday ways to start teaching kids about money. The back-to-school season is the perfect time to begin.

5 min read

The Smart Splurge: Why Sometimes the Best Money Move Is Spending

Because financial wellness isn’t just about cutting back.

Explore the latest Blogs